While it would take a substantial amount of time and study to understand your financial statements the way an accountant does (they study for an average of 6 years to qualify as a Chartered Accountant or Certified Practising Accountant), it is possible for the Directors on a Board of Directors to understand their financial statements sufficiently to fulfil their duties as Directors.

As a Director, one of your duties is to be diligent in your role. This means that you must "pay attention". You cannot dismiss the financial side as "someone else's responsibility."

Therefore, in order to fulfil this part of your legal duties, you need to understand how financial statements are prepared, what is contained in them, and what type of questions to ask when you are unclear.

You do not need to understand them like a trained accountant - only sufficient to understand what's going on in your organisation and whether to feel comfortable with the results or make inquiries until you are satisfied.

The best defence against fraudulent activity - or to recognise approaching insolvency - is not the Auditor, but your own sense of understanding what is going on.

Your financial statements are only reports, prepared at the end of a cycle of work.

They are the output of your financial management system, so we shall first look at what is a financial management system.

A financial management system includes all the activity to create income, incur expenses, and then record those transactions and report on what has happened. It also involves applying sufficient internal controls over the cash and assets so as to protect the corporation from mistakes or fraud.

So, financial management involves:-

- Making and then recording transactions - payments, receipts, incurring invoices payable, creating and collecting income. This is the matter of "book-keeping".

- Ensuring that systems are in place to authorise orders made and payments and that the system records the authority given. This is about ensuring the right controls are in place.

- Making decisions about assets and liabilities such as buying significant assets, talking out loans or placing an order for a substantial purchase. This is about responsible decision-making about spending.

- Keeping cash and other assets safe, using physical means (like using passwords) as well as through proper delegations and the use of signatures to show approval - this is about security and controls.

- Ensuring the corporation stays within the law in regard to how it spends money. The Directors are only "stewards" or caretakers of the corporation assets and need to ensure that what it does is legal.

- Reporting to the owners (members) in a full and fair manner. This is about preparing complete and fairly presented financial statements and getting them audited.

The various legislation places the Directors responsible for implementing an appropriate financial management system.

Often, Directors of Indigenous corporations think it is enough to hire a credible accountant, and then let him or her handle all financial matters, even allowing him or her to deal with the Auditors as if financial management was some kind of disease.

This is a potential recipe for disaster.

There have been many examples of Indigenous corporate collapse where the Directors simply have not known about any mistakes or fraud until too late. Or, at best, not known about how close they come to running out of cash to operate.

Directors must take an interest.

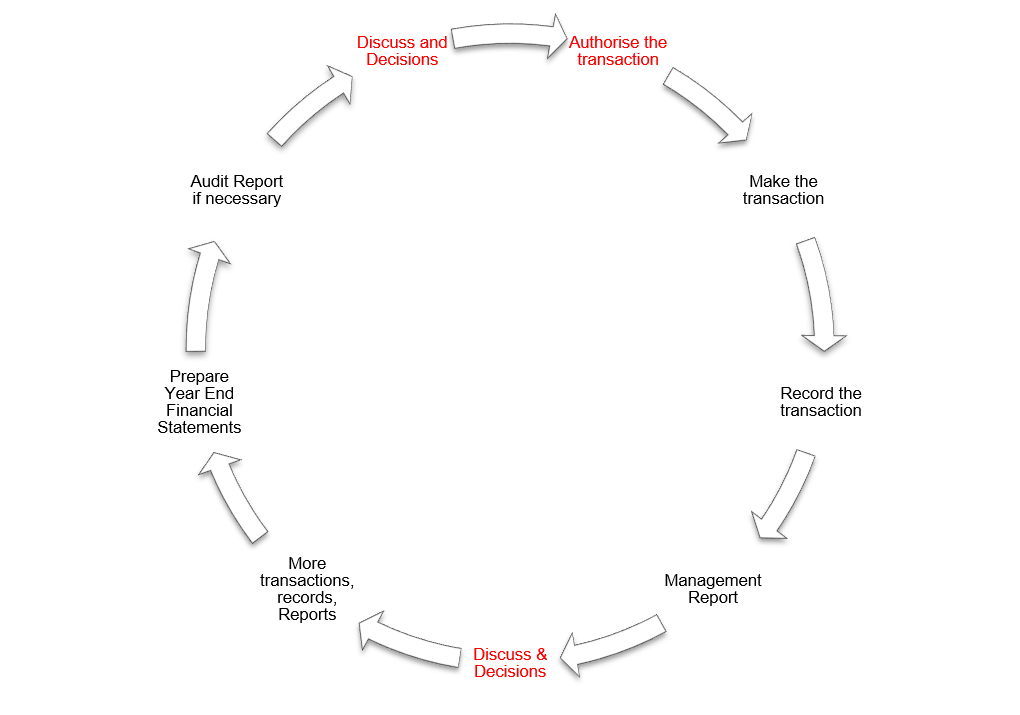

First, understand the financial management cycle:

FM cycle

Also, understand that financial management is not only about "doing the work" which is the work of your bookkeepers and accountant, but also about ensuring the proper controls are in place.

The most important part of these controls is what is called the "Internal Control System".

This is the system of controls where checks and balances are automatically carried out as part of the financial records, and implementing an Internal Control system helps the Board fulfil their legal duties.

An Internal Control System involves:

- Physical security - the use of a safe to keep cash where the combination is only known to one or two delegated people; where assets are locked up when not in use; where banking passwords are only issued to one or two traceable and responsible people, and so on.

- Separation of Duties - where at least two people must take on duties that "check" on each other. For example, the person who places an order for purchasing, should not be the person who authorises payment to the supplier.

- Delegated authorisation - where people are given levels of authority, for example, if a purchase is over $1,000 then only the Manager can approve, and so on up to the Board approving substantial figures.

- Evidence and records - meaning that as each delegate or authorised person approves a transaction, there should be a record of that approval such as a signature on a docket or the use of their personal password, and so on.

The system of internal controls serves to automatically safeguard assets and double-check transactions as well as to pinpoint the person who approved something without appropriate authority or delegation.

You do not have to try to figure out an appropriate Internal Control System on your own - you can always ask your Auditors or independent accountant to help you implement a secure system.

During your annual audit, your Auditor will check your Internal Control system along with other matters.

If they give you an unqualified Audit Report, it does not automatically mean that everything is above board - they may simply not have found anything in their work.

To understand how this can happen you need to understand that the Auditor only test-checks systems and important balances. They do not check 100% of the transactions - not even in those important balances. They look to see if, on balance, it "looks right". As a Director, make sure you understand this and discuss with your Auditor any areas of concern that they will put in their Letter to Management (a report outside the annual Audit Report but which may talk about areas of concern not sufficiently concerning enough to be in the Audit Report but which may represent problems for you).

Finally, get to understand your financial statements.

They are usually made up of two main components, being the Profit and Loss Account (or Income and Expenditure Statement, or something that sounds like income in/expenditure out reports), and your Balance Sheet.

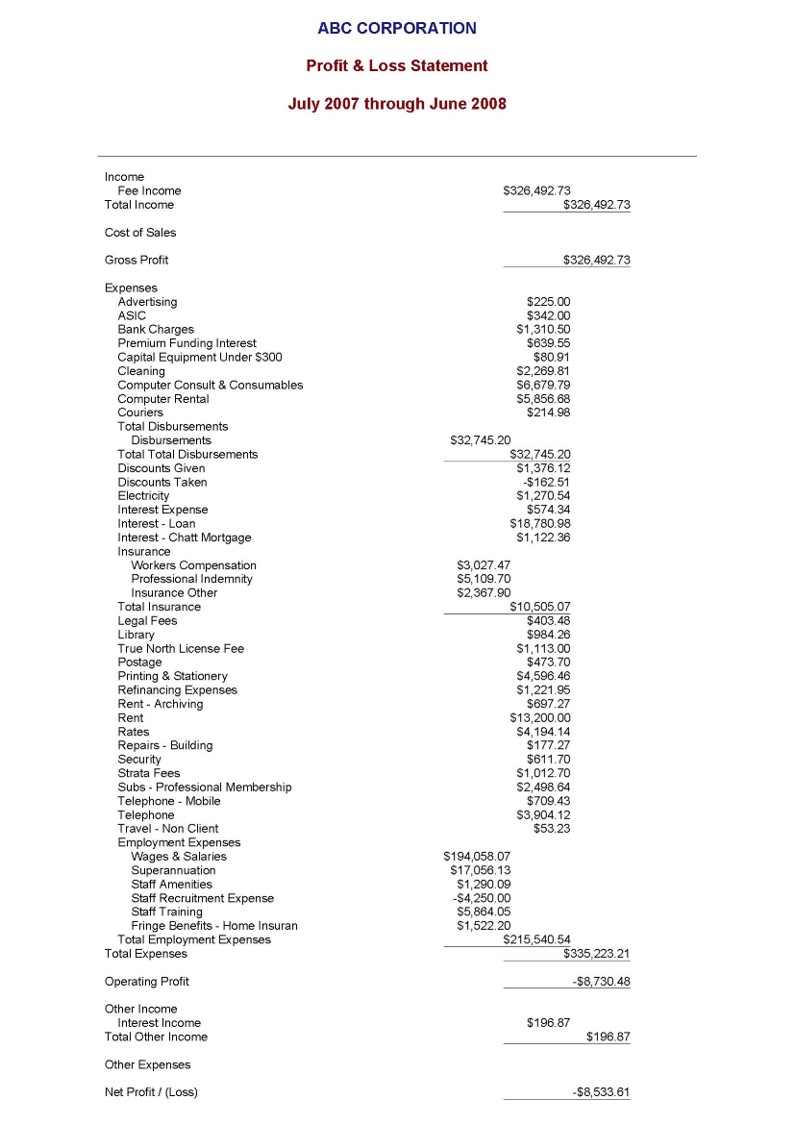

Your Profit and Loss Account/Statement or Report will look something like this:

Profit & Loss

You should be able to recognise it by seeing that it contains figures showing Income, as well as figures showing Expenses or Expenditure.

Your Profit and Loss captures all the income you receive and takes off from that, all the expenses you incurred, in a given period.

It is important to note that it is for a given period in time - in the above picture it is for the period July 2007 to June 2008. Usually, it is for a year, but sometimes management might give you monthly or quarterly reports during the year.

What it tells you is that:

- During (only) the period it is reporting,

- You received what income,

- Against which you spent what expenditure,

- Leaving you with a Profit or Loss - for that period.

You can use this to see how well or how badly you have done financially in that given period.

You can also use it to compare against other periods - for example, Quarter 2 against Quarter 1 - to see if you have improved or gone backwards.

You can also use it to question levels of expenditure or even what was being spent. In the above picture, you will see that there are "Computer Consulting & Consumables" of $6,679.79. If as a Director you realised that during the year you hired your own IT specialist, you would want to ask what that expenditure was for and whether you had saved money from hiring your in-house IT specialist.

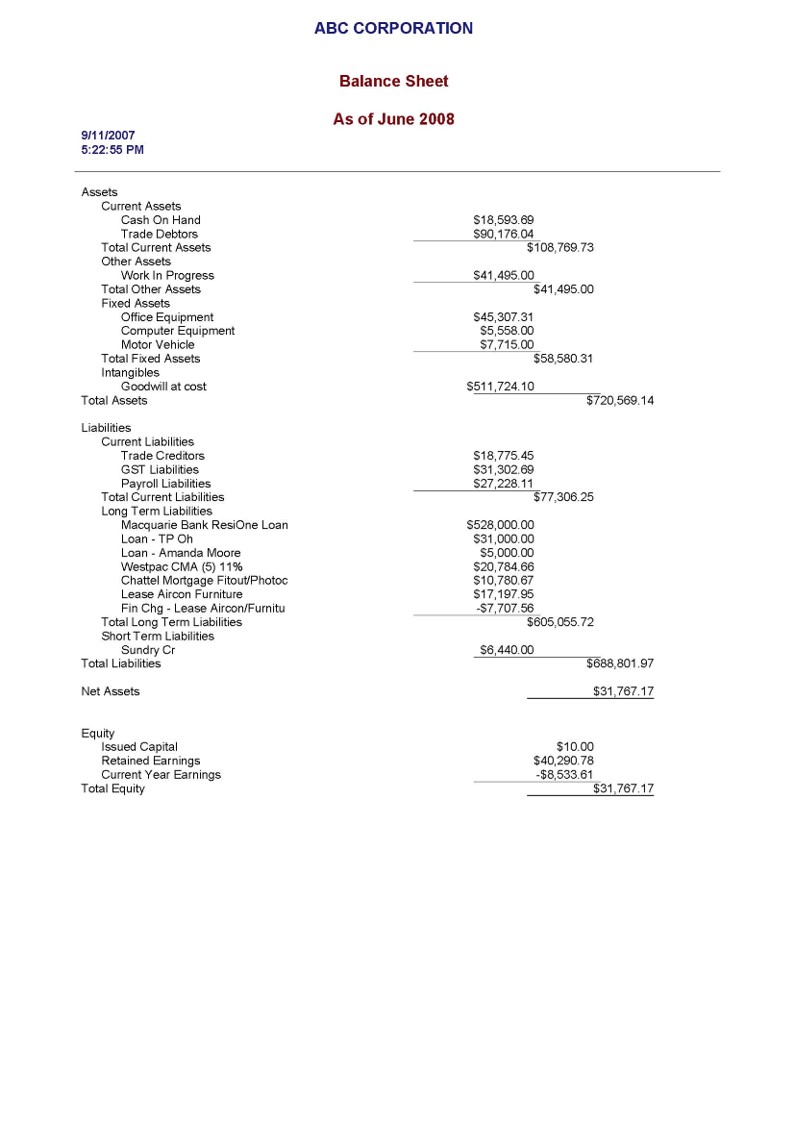

Your second main financial report is your Balance Sheet. It looks something like this:

Balance Sheet

You will recognise it because it will contain words like "Assets" and "Liabilities".

Your Balance Sheet is for a given day. It shows you the value of your corporation on the date given.

In the example above that date is at the end of June 2008. It shows you:

- What assets (things including cash that you own) you had on that day,

- What liabilities (what you owe people) you had on that day,

- And the difference between the two, which is your "equity" or net worth.

If you have more assets than liabilities, you are said to have "net assets" or positive net worth. If you had more liabilities than assets, you are said to have "net liabilities" or a negative value.

Your Balance Sheet can show you:

- Your financial strength

- Whether you are solvent (although this may only be an indication and you may have to explore further)

It can also report to you what you have bought or invested in. For example in the picture above, you can see a "Trade Debtors" of $90,176.04. As a Director, and knowing that "Trade Debtors" is what other people owed you, you might want to know why it is quite a high figure, who owes the bulk of that money, how long it has been outstanding, what has been done to chase it up, and so on.

In summary, your financial statements should not be treated as something to be afraid of.

Understand enough of what you are shown. Ask intelligent questions - that is not only your right as a Director, but it is also your responsibility.

As part of our work on governance that we do with Indigenous corporations, we have provided training to Boards about their financial responsibilities and understanding.

If you would like some assistance in governance and financial training, or if you would like a more detailed consultation about your financial affairs, please send us an email to or call us on 08 9242 2085.

Oh, and of course, we hope you have read this far because we would like to wish you all a merry Christmas and a Happy New Year!